At the January 27, 2026 Montclair Town Council meeting a discussion on the Redeveloper application for a PILOT in connection with the Lackawanna Redevelopment Project was presented. What follows is a verbatim transcription of Mike Hanley’s, NW Financial Group, LLC, presentation. Markers are provided to enable readers to refer back to the video https://www.youtube.com/watch?v=JK9oCLxk25w

Beginning at the 2:30 marker:

Mike Hanley from NW Financial representing the Municipality, um you know the in addition to the redevelopment agreement we are looking at a financial agreement related to this project. There are a couple of important things we review.

First and foremost, whether a financial agreement and the assistance associated with that is necessary for a project like this. As um Janice clearly described, the redevelopment plan and redevelopment agreement were very important to the municipality, and you worked on them for years to get to a place where you are getting the public amenities and the improvements and the type of development you want on this site.

And it’s a very complex development that includes um historical improvements[1 No description of “historical improvements” provided], rehab of an existing building, infrastructure improvements, and that is can create a very expensive project.

There are projects throughout the state that are facing challenges[2] No examples of projects in the state that are facing challenges were identified] similar to this, but this is very difficult for because it has all of these high cost items[3 Specifics of “high cost” items were not provided].

Um and while revenues have increased across development types particularly residential and industrial not so much as it relates to office um they have not kept up with the costs with interest rates and with the challenges associated with this site.

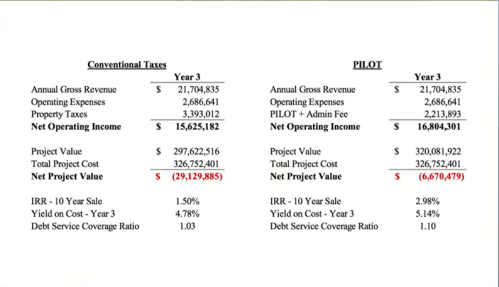

So you can see on the screen you have an investment here that will be over $300 million in your community. It’s a major investment. Um and if it were conventionally taxed it would have a negative project value[4 See Exhibit A], a yield on cost that was below 5%. Um neither of which are economically desirable for an investor. Um, even with your assistance and we think the terms that have been negotiated here and we’ll go through them on a later slide, the economics are not strong for the project.

Even if you determine that you want to move forward with this financial agreement you can see the uh yield on costs is just over 5%. Um and you do have a slightly net negative net project value.

Now this developer wants to move forward under these terms and believes that the performance of this project will exceed what’s expected and what’s projected and is willing to take financial risk[5 Any and all investment is risky, anyone who is risk averse should not be in the development business] to cause that to occur.

But um you know myself and my firm have reviewed this project and we think there is no doubt that financial assistance is justified. Go onto the next slide.

So, you know, why wouldn’t a municipality ever do something that is different from conventional taxes in the context of causing a project to move forward. And the first reason after the development reasons and the policy reasons for getting the project that you would like to incur[6 The meaning of incur is to become liable or subject to] is financial and it’s to generate more revenue than you’re getting today.

Exhibit A

You know, this project is generating something like $400,000 in taxes to you. And that is, you know, you have gotten through the redevelopment project because it is an underperforming site in your municipality. When it is fully built out, that $400,000 even with your financial assistance, will generate over $2 million in annual service charge, which is colloquially known as a PILOT.

Um, it you know the financial agreement does not mean that the developer does not pay. The development does pay but instead of paying as a conventional taxpayer the municipality does become a partner[7 The meaning of partner used in this context means a member of a partnership especially in a business] in the project and they are paid based on revenue that’s generated there[8 There have been sales of two large residential projects with PILOTs in Montclair for significant profits and Montclair received nothing].

So you will be paid based as as a percentage of revenue generated on the project. That percentage of revenue is tested and you will receive an audited financial by a licensed auditor in the State of NJ each year. Um that identifies exactly the amount of revenue that’s generated and determines whether or not the projected tax payments are sufficient. And if the revenue is in fact greater, you will receive a true-up payment that is in excess of what you billed. Um and as you can see, this assumes the whole project is built as one at once, but the existing taxes of $16 million can be turned into over Hundred million over a 30 year term.

Um, so we’ll go on to the next slide.

The um, pilot is calculated two ways and there are some acronyms on the screen. They’re the two left columns. As I discussed earlier, you have the percentage of gross revenue. So the whatever the developer brings in in revenue, you are entitled to a percentage of and I would say the terms that have been negotiated are very favorable to the municipality as it related to what are received in other PILOTs around the state, starts at 10% for 5 years, increases to 11% for 5 years, goes to 12 ½% for 10 years and then 13 ½% for 10 years.

There are there’s also a second test uh in the column we call it OAT. It’s Otherwise Applicable Taxes. So if the percentage of applicable taxes that is implied in the particular year is greater than the percentage of revenue that’s what you will receive. Um there’s an additional protection for the municipality in these agreements. The developer will have to form a limited dividend entity such that if the developer exceeded the maximum profits under the statute[9 No Statute was quoted] those profits would have to be paid back to the municipality.

All of those things are protections and benefits for the municipality. But you are a partner in the project and its success is your success. Um so that I uh is the end of the summary and happy to take questions around the financial or uh you know I’m sure Joe and Janice can answer other questions around the documents or the plan.

D’Amato I just have a small question. Um there’s also uh the land the tax on the land itself stays as a as a separate stream. Is that correct? Or some portion thereof.

Hanley Yeah. The land taxes will be credited against the PILOT payments that are made.[10 Full answer was not transcribed as it is repetitive] [11 The video is at the 2:38 marker]

D’Amato I have another question which is a bigger one which is that we’re looking at columns of numbers. These are all projections. How would you characterize uh characterize uh uh um uh the probability of these numbers being accurate? I think I totally trust I actually very much trust your alluding not all all projections are accurate, right? Especially about the future, right?

Hanley I think as Yogi Berra said the assumptions that underly the numbers are fair. Then you know, we take a look at all types of rents that are being collected and agree that they are reasonable rents across the development types and are likely to produces this type of a revenue stream when built out. Now they assume that rents will grow which is consistent with our historical experience[12 No historical experience time period was referenced]. Um, but they could grow faster, they could drop, they could grow more slowly. We are going to be a partner in the revenue stream and to the extent the developer does better we will do better as well.[13 Montclair’s PILOT experience does not support this representation.]

Harrison Currently what is the breakdown between taxes on the land and taxes on the improvements.

Hanley Uh, I would have to check. But I have to look at which how it’s split currently. As it is developed each piece it will receive a new assessment both as it relates to land and improvements. And the land tax will continue to increase on new entitlements[14 First usage of this terminology “entitlements” in the presentation / question and answer period] and improvements over time. The service charge begins when you have temporary COs[15 CO = Certificate of Occupancy] on the building and revenue is being generated.

Harrison How long is that likely to take?

Hanley Uh 24 to 36 months

In response to Anderson request to translate into layman’s terms

Hanley Yeah. So I mean in the short term we ‘re going to be relying on percentage of gross revenue.

Toler Asked if the project will have a deficit.

Hanley That is right around a break even project. That is not the goal of developers. This developer is taking a risk on future performance that is not typical[16 Developers ALWAYS take risks on future performance].

Birmingham We did independently verify like we asked for a um we had our own firm verify these projected costs to make sure that they weren’t being[17 See Exhibit A Project Costs. There is no mention of independently verifying Project Value, an amount that is equally as important to verify as Project Costs.].

Hanley That’s right. You had a professional cost expert come in to evaluate whether for some reason if those were inflated such that it would make the project appear to have more need than it did.[18 The video is at the 2:47 marker] And they didn’t, you know, they did not think the costs were inflated. If anything, they thought they were aggressive.[19 No definition of “aggressive” was given. The assumption is that the costs are lower than expected based upon Hanley’s response.]

Birmingham Questions challenges: historic site, building over water, building with old infrastructure[20 No explanation for what “old infrastructure” comprises], building in the face of litigation.

Hanley This project has lots of needs because it’s a rehabilitation of an existing building because there are historical challenges because the municipality required certain types of improvements to be put on the project. You know, between 10 and 20% of the project costs probably[21 Probably is not a term that provides any level of assurance that an analysis was performed] come from those needs, the infrastructure, the historical needs, the uh public space, etc. And when you drive up the cost of a project, it drives down the global economics of that project. And and I mean I I can tell you the environment generally in the world has caused far more projects to have need than did five years ago or 10 years ago.[22 There are several projects that were built and completed in Montclair over the past 5 years.] And that’s you know there are a number of cost items that have increased[23 No examples of specific cost increases were identified] in a way that exceeds the value of the revenue increases. So interest rates went from you know developers borrowing at 3%[24 The Federal Reserve and Treasury policy maintained interest rates artificially low for over 14 years after the sub prime mortgage market collapse which effected the greatest transfer of wealth in history. These low rates were exploited to increase the wealth of the wealthy and created the increasing wealth gap that is destroying the fiber of communities.] on construction loans to 9% 10%[25 Interest rates were significantly higher in the 1980’s 12% to 15%], the cost of materials.

A few members of the public were permitted to ask questions of the financial advisor with respect to the financial agreement that he recommends (not transcribed) at the conclusion of the presentation portion of the meeting.

[1] No description of “historical improvements” provided

[2] No examples of projects in the state that are facing challenges were identified

[3] Specifics of “high cost” items were not provided

[4] See Exhibit A

[5] Any and all investment is risky, anyone who is risk averse should not be in the development business

[6] The meaning of incur is to become liable or subject to

[7] The meaning of partner used in this context means a member of a partnership especially in a business.

[8] There have been sales of two large residential projects with PILOTs in Montclair for significant profits and Montclair received nothing.

[9] No Statute was quoted

[10] Full answer was not transcribed as it is repetitive

[11] The video is at the 2:38 marker

[12] No historical experience time period was referenced

[13] Montclair’s PILOT experience does not support this representation.

[14] First usage of this terminology “entitlements” in the presentation / question and answer period

[15] CO = Certificate of Occupancy

[16] Developers ALWAYS take risks on future performance

[17] See Exhibit A Project Costs. There is no mention of independently verifying Project Value, an amount that is equally as important to verify as Project Costs.

[18] The video is at the 2:47 marker

[19] No definition of “aggressive” was given. The assumption is that the projected costs are lower than expected based upon Hanley’s response.

[20] No explanation for what “old infrastructure” comprises.

[21] Probably is not a term that provides any level of assurance that an analysis was performed.

[22] There are several projects that were built and completed in Montclair over the past 5 years.

[23] No examples of specific cost increases were identified.

[24] The Federal Reserve and Treasury policy maintained interest rates artificially low for over 14 years after the sub prime mortgage market collapse which effected the greatest transfer of wealth in history. These low rates were exploited to increase the wealth of the wealthy and created the increasing wealth gap that is destroying the fiber of communities.

[25] Interest rates were significantly higher in the 1980’s 12% to 15%

Leave a comment