The NJEA is classified as a 501(c)(5) organization under the Internal Revenue Code (”IRC”). This means the organization is exempt from income taxes.

A 501(c)(5) organization may engage in political campaigns on behalf of or in opposition to candidates for public office provided that such intervention does not constitute the organization’s primary activity. The promotion of Sean Spiller for governor of the state of New Jersey has become the primary activity of the NJEA.

Any 501(c)(5) organization that makes political expenditures is subject to tax under IRC 527 whether or not the expenditures are made directly or through another organization. These expenditures are required to be reported on Form 990, Schedule C, Political Campaign and Lobbying Activities. When this form is properly completed, the filing for Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations is triggered.

Political Contributions versus Charitable Contributions

The fraud the NJEA has perpetrated is rather than report political contributions correctly on Form 990, Schedule C, they have reported political contributions on Form 990, Schedule I, “Grants and Other Assistance to Organization, Governments, and Individuals in the United States”. The phrase “grants and other assistance” means charitable contributions, which you can see here (Form 990 page 34, where $6,000,000 is reported as charitable contributions to Garden State Forward):

Political contributions are not charitable contributions. The deliberate misclassification of political contributions to Garden State Forward as charitable contributions is fraud.

Independent Expenditure Committees

Both Garden State Forward and Working New Jersey are organized as “Independent Expenditure Committees”. The Internal Revenue Service defines independent expenditure as “an expenditure by a person for a communication expressly advocating the election or defeat of a clearly identified candidate that isn’t made with the cooperation or prior consent of, in consultation with, or at the request or suggestion of, a candidate or agent or authorized committee of a candidate.”

It is legal to make contributions to Independent Expenditure Committees. It is not legal for a 501(c)(5) Labor organization to do so from members dues that are not explicitly deducted with the member’s written authorization from their salary as political contributions.

Garden State Forward

Garden State Forward is funded 100% by the NJEA. Over $115 million has been transferred from the NJEA to Garden State Forward since 2013. This is easily verified by reviewing Forms 8872 filed by Garden State Forward by clicking on this link: https://forms.irs.gov/app/pod/basicSearch/details?searchOrgName=Garden%20State%20Forward&searchFormType=Form%208872&ein=&pacId=49048&pacInfoId=49048&fromDate=&toDate=

Internal Revenue Code Regulation 1.501(c)(5)-1(a)(1) prohibits the inurement of earnings to the benefit of any member of the 501(c)(5) organization. In his leadership role within the NJEA, Sean Spiller, is a member with a direct conflict of interest.

The table below summarizes funds transferred from NJEA between April 2022 and May 2025 to Garden State Forward and expended for the explicit benefit of Sean Spiller.

| Government Agency | Form | Date of payment | Name of entity | Amount |

| Internal Revenue Service | 8872 | 4/27/22 | Protecting Our Democracy | $1,000,000 |

| Internal Revenue Service | 8872 | 9/12/22 | Protecting Our Democracy | $2,000,000 |

| NJelec | R-1 | 1/26/24 | Protecting Our Democracy | $2,000,000 |

| Internal Revenue Service | 8872 | 7/29/24 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 7/30/24 | Working New Jersey | $3,000,000 |

| NJelec | R-1 | 7/31/24 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 8/1/24 | Working New Jersey | $1,250,000 |

| Internal Revenue Service | 8872 | 11/27/24 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 11/29/24 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 12/2/24 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 12/3/24 | Working New Jersey | $1,000,000 |

| Internal Revenue Service | 8872 | 2/3/25 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 2/4/25 | Working New Jersey | $2,000,000 |

| Internal Revenue Service | 8872 | 3/14/25 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 3/17/25 | Working New Jersey | $2,000,000 |

| Internal Revenue Service | 8872 | 4/24/25 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 4/25/25 | Working New Jersey | $1,750,000 |

| Internal Revenue Service | 8872 | 5/15/25 | Working New Jersey | $3,000,000 |

| Internal Revenue Service | 8872 | 5/16/25 | Working New Jersey | $2,000,000 |

| $45,000,000 |

Protecting Our Democracy

Protecting Our Democracy (“POD”) was incorporated March 4, 2022 and its first board of trustees includes Kathryn Weller Demming, a frequent Spiller collaborator, a former member of the Montclair Board of Education – appointed by Spiller, and a complicit member of the kakistocracy that reflects the democratic party of New Jersey. 100% of the funds transferred to POD were used to promote Sean Spiller through a blitz of advertising media campaigns.

Working New Jersey

Working New Jersey filed form D-6, Independent Expenditure Committee – Registration Statement and Designation of Campaign Treasurer and Depository with the New Jersey Election Commission on August 8, 2024.

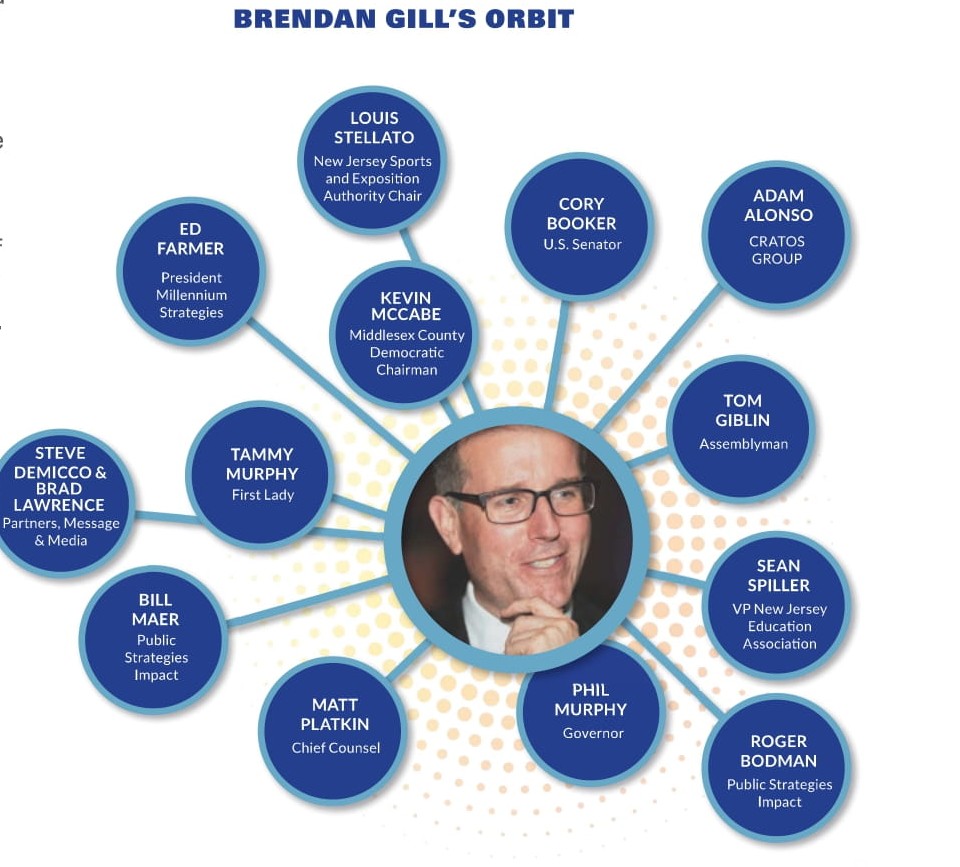

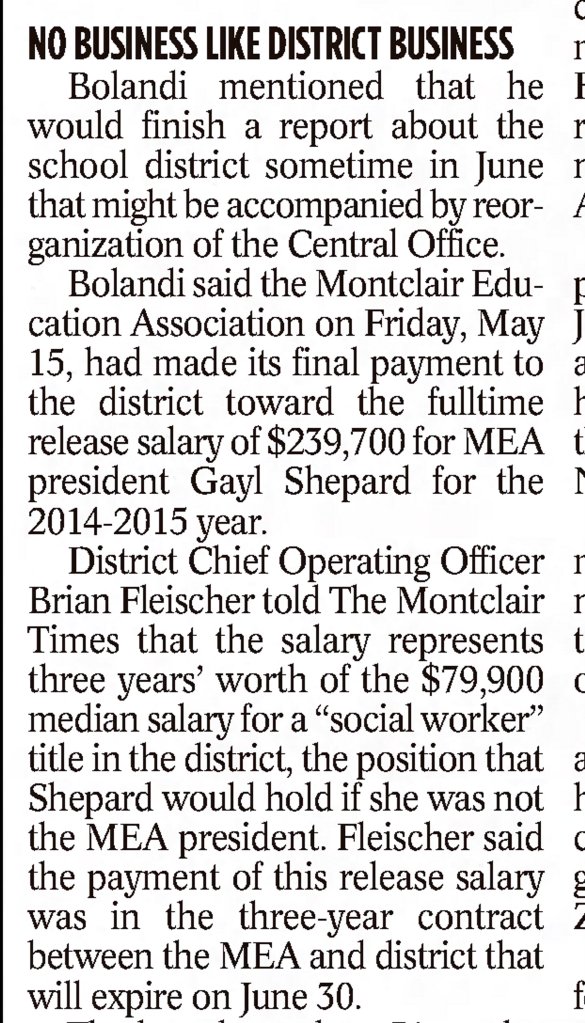

The Chairperson, Ed Richardson, is a former Executive Director of NJEA who received compensation of over $6.5 million between September 1, 2015 and August 31, 2021. That’s an average compensation package of over $1,000,000 annually. The Treasurer, Gayl Shepard, is a resident of Montclair, NJ and former Montclair Education Association President.

Election Transparency Act

Lest it be forgotten, the “Elections Transparency Act” signed by Governor Murphy in April 2023 deliberately obfuscates accountability and transparency by independent expenditure committees such as Garden State Forward and Working New Jersey, both fully funded by illegally misappropriating teachers’ dues funded by the taxpayers of New Jersey.